Loan Officer Vs Mortgage Broker, Why Use A Mortgage Broker Or Loan Officer

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcrytchrulovpevzqh23ty Kg8fuszw3lpjbztfsdai0veg5btg1 Usqp Cau

- Mortgage Brokers Vs Banks The Truth About Mortgage

- Mortgage Brokers Over Loan Officers Mortgage Brokers Mortgage Loan Officer

- How A Mortgage Broker Can Save You Time And Money Bankrate

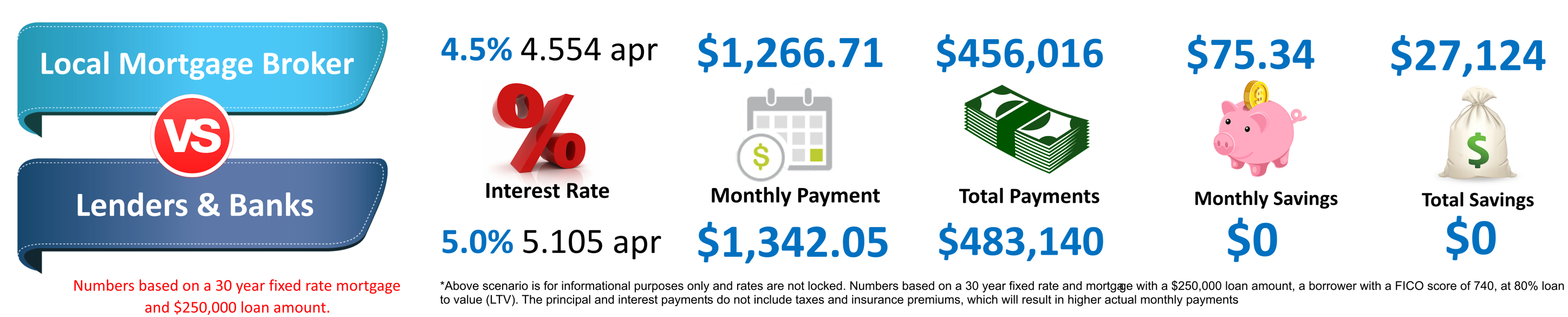

- Using A Local Mortgage Broker Loan Officer Vs A Bank Drew Gilmartin

- Mortgage Brokers Vs Bank Loan Officers Smart Mortgage Investments

- The Difference Between A Bank Loan Officer And A Mortgage Broker

- How To Find A Home Mortgage Broker Or Bank Loan Officer

- Differences Between Mortgage Brokers And Loan Officers North Miami Beach S Mortgage Professional 305 733 3606

- Choosing A Chilliwack Mortgage Broker Vs A Bank Loan Officer Mortgage Payoff Mortgage Loans Refinance Mortgage

Find, Read, And Discover Loan Officer Vs Mortgage Broker, Such Us:

- 4 Guidelines I Use To Find A Mortgage Broker Jay Bird Blog

- Differences Between Mortgage Brokers And Loan Officers North Miami Beach S Mortgage Professional 305 733 3606

- Mortgage Broker Vs Mortgage Loan Officer New Florida Mortgage

- Resources To Be A Better Loan Officer Or Mortgage Broker

- Mortgage Broker Resume Samples Qwikresume

If you are looking for Office Space Receptionist you've come to the right location. We ve got 104 images about office space receptionist adding pictures, photos, pictures, wallpapers, and much more. In such webpage, we additionally have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

A loan officer also called an account executive or loan representative represents the borrower to the lending institution.

Office space receptionist. Loan officers are affiliated with a single lender in most cases. Mortgage broker vs loan officer. When it comes to a mortgage broker vs loan officer a broker can give you additional options.

They may be able to offer loans to fit many different situations but all the loans will be products of the same lender. Brokers are independent agents connected to many lenders. However a loan officer is also licensed as a mortgage loan originator mlo which means they may also work for a mortgage broker andrews said.

Mortgage brokers and loan officers have basically the same goals which are making loans to people looking to buy property. Since the dodd frank financial rules went into effect in 2012 mortgage loan officers make far less per transaction than real estate agents. Mortgage brokers are individuals who work independently to help home.

There may be a variety of loans types to choose from but all are programs of that specific lending institution. Loan officers are not licensed and do not go through yearly education or certification. The more expensive the mortgage the more the broker gets paid.

Loan officers work for a specific lending institution such as a bank who work with mortgages and other lending programs on behalf of their company alone. In other words a mortgage broker is a type of mortgage business while a loan officer is a salesperson paid to give you the information needed to choose a mortgage that fits your needs. But theres a downside.

By choosing an officer you have limited options overall. Lenders are the ones who front the money to fund your loan. Understanding the difference between a bank lender loan officer and a mortgage broker with bay area realtor phil evans and loan officer phil caulfield.

Mortgage brokers often are confused with mortgage banks although they are very different. Before splitting or sharing their commission with real estate brokers real estate agents can make 3 to 6. Good mortgage brokers should be able to find borrowers the most competitive rates and also find loans for borrowers with less than perfect credit.

They typically make their money through commissions on the loans. The borrower gives a commission to the broker if the loan closes. The main difference between a mortgage broker and a loan officer is that a loan officer works for a lending institution a bank credit union or others to process loans solely originated from that institution.

Office Space Receptionist, The Ultimate Introduction To Mortgage Brokers Tundra Mortgage Brokers

- How A Mortgage Broker Can Save You Time And Money Bankrate

- Loan Officer Vs Mortgage Broker Youtube

- Mortgage Brokers Vs Bank Loan Officers Alliance One Mortgage

Office Space Receptionist, Broker Vs Banker Vantage Mortgage Group

- Mortgage Broker Bristol Loans Mortgages Loan Officers Mortgage Brokers United Kingdom Un

- What S The Difference Between A Loan Officer And A Mortgage Broker Mercer Island S Mortgage Professional 425 637 7450

- What S The Difference Between A Loan Officer And A Mortgage Broker Weston S Mortgage Professional 954 486 6000

Office Space Receptionist, Free Download Mortgage Broker Loan Officer Marketing Basic Training A Complete Marketing Video Dailymotion

- Should You Use A Mortgage Broker Or A Bank Loan Officer Money Under 30

- Choosing A Chilliwack Mortgage Broker Vs A Bank Loan Officer Mortgage Payoff Mortgage Loans Refinance Mortgage

- The Ultimate Introduction To Mortgage Brokers Tundra Mortgage Brokers

More From Office Space Receptionist

- Free Office Software

- The Office Cathy

- Collin County Tax Office

- Regional Office Of Education

- Best Ergonomic Office Chair

Incoming Search Terms:

- Mortgage Broker Versus Bank Loan Officer Who Should You Choose I Compare You Save Best Ergonomic Office Chair,

- Free Download Mortgage Broker Loan Officer Marketing Basic Training A Complete Marketing Video Dailymotion Best Ergonomic Office Chair,

- What S The Difference Between A Loan Officer And A Mortgage Broker Mercer Island S Mortgage Professional 425 637 7450 Best Ergonomic Office Chair,

- Mortgage Brokers Over Loan Officers Mortgage Brokers Mortgage Loan Officer Best Ergonomic Office Chair,

- Should You Work With A Mortgage Broker Forbes Advisor Best Ergonomic Office Chair,

- Types Of Mortgage Lenders The Truth About Mortgage Best Ergonomic Office Chair,