Brazos County Tax Office, Brazos County Tax Office Construction On Track Local News Theeagle Com

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gctustpxxhg2b1f Ycf3q9nykjgsr5cd5jmtmkdcldg8fm71ze8p Usqp Cau

- Brazos County Tax Office Ldf Construction Inc

- Eagle Ford Shale Brazos County Tx Eagle Ford Shale Play

- Working At Brazos County Tax Office Employee Reviews Indeed Com

- Two Former Brazos County Employees Arrested For Alleged Scam At Tax Office

- Property Tax Loan In Brazos County Ovation Lending

- Brazos County Texas Genealogy Familysearch

- Contract Awarded To Renovate Former Brazos County Tax Office Building Wtaw 1620am 94 5fm

- Brazos County Mailed Out 115 000 Tax Bills On Tuesday To Property Owners

- Wayne Dicky Wins Race For Brazos County Sheriff Earl Gray Elected County Attorney Local News Theeagle Com

Find, Read, And Discover Brazos County Tax Office, Such Us:

- How To Avoid Long Lines At The Brazos County Tax Office Wtaw 1620am 94 5fm

- Brazos County Administration Building Downtown Bryan 2 Tips From 111 Visitors

- Brazos County Tax Office Adding Title Transfer Services

- Brazos County Administration Building Downtown Bryan 2 Tips From 111 Visitors

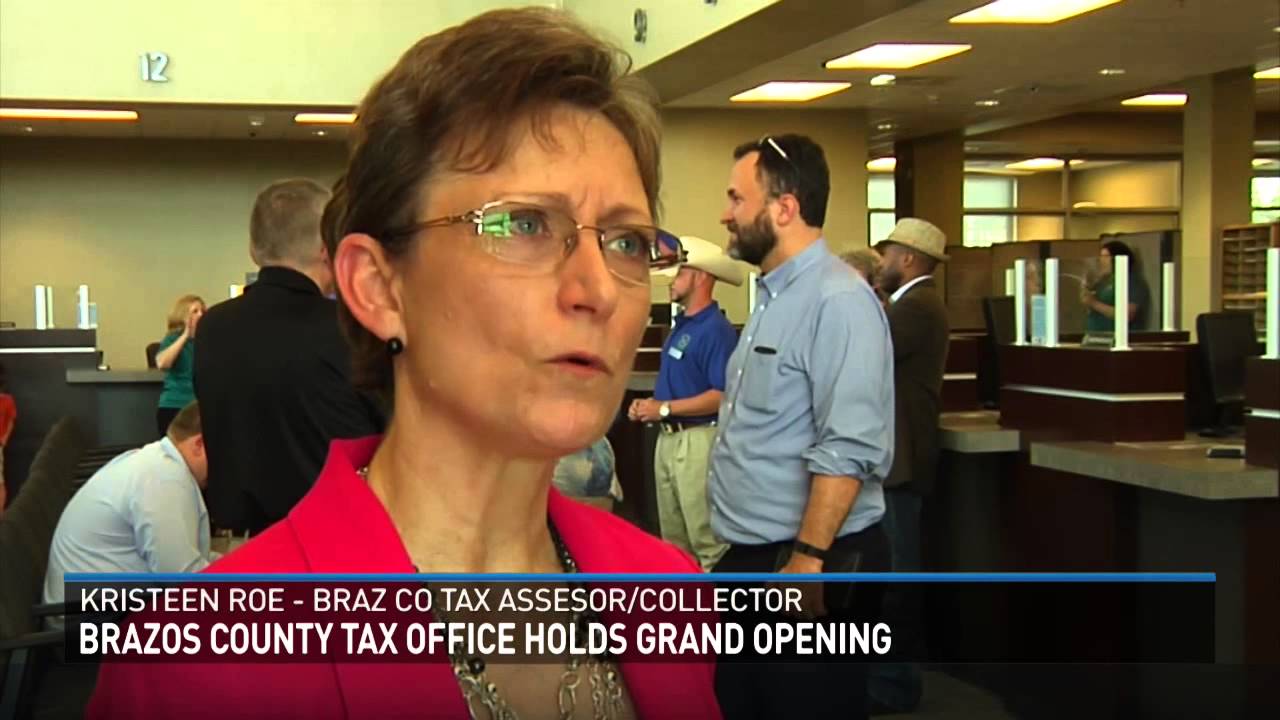

- Brazos County Tax Office Holds Grand Opening Youtube

If you are looking for Herman Miller Office Chair you've reached the perfect location. We have 104 images about herman miller office chair including images, photos, pictures, wallpapers, and much more. In these webpage, we additionally have number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcrhfvhygtdxspl9zqpbuoctgqjtte3xj2mef7dl4cop2aghnjsh Usqp Cau Herman Miller Office Chair

One problem is they have only one person doing vehicle registrations.

Herman miller office chair. However this material may be slightly dated which would have an impact on its accuracy. Brazos county tax office. Please contact your county tax office or visit their web site.

For additional information please contact us at 979. Regular office hours are 800 am to 430 pm monday through friday. Please call the tax office with questions or for assistance.

All payment received at the appraisal districts will be returned to the. Payment may be made in person or by mail to. All property tax payments must be made out to.

Information on specific property tax accounts can be accessed through the brazos county tax office website. Although the publics access is still limited to provide enough social distancing it will. County tax assessor collector offices provide most vehicle title and registration services including.

Brazos county has one of the highest median property taxes in the united states and is ranked 238th of the 3143 counties in order of median property taxes. Notice the brazos county tax office is now located at 4151 county park court in bryan tx. Payments cannot be made to the brazos central appraisal district.

6 reviews of brazos county tax office new building is in a ridiculous location. The tax assessor collector provides consolidated tax assessment and collection services for all taxing jurisdictions within brazos county. Any errors or omissions should be reported for investigation.

Kristeen roe brazos county tax ac. Brazos county tax office 4151 county park ct. The brazos central appraisal districts appraisal staff will be out inspecting properties throughout brazos county for the 2021 tax year from august 2020 through may 2021.

The median property tax in brazos county texas is 2657 per year for a home worth the median value of 141700. Brazos county collects on average 188 of a propertys assessed fair market value as property tax. Brazos county tx tax makes every effort to produce and publish the most accurate information possible.

Property tax payments can also be made through the mail dropped off in the night deposit in lane 1 at the tax office or handled through the drive through windows. Registration renewals license plates and registration stickers. The appraisers fieldwork will consist of verifying any new improvements taking measurements of any improvements checking agricultural practices checking wildlife management practices and inspecting for business.

They had an automated system to assign you a window to pay your taxes etc.

Herman Miller Office Chair, Moving To The New Brazos County Tax Office Next Week Wtaw 1620am 94 5fm

- Brazos Valley Government And Judicial Offices Closed Kagstv Com

- We Re Open Caffe Capri Is Thankful For Their Community And Secret Sauce Recipe During This Pandemic News Break

- Brazos County Tax Office Texas Bryan County Government Finance Taxation 4151 County Park Ct 77802 9797759930

Herman Miller Office Chair, County Tax Office Gearing Up For Big Move Kagstv Com

- Property Tax Loan In Brazos County Ovation Lending

- Brazos County Tx Jail Inmate Locator Bryan Tx

- County Tax Office Gearing Up For Big Move Kagstv Com

Herman Miller Office Chair, Wayne Dicky Wins Race For Brazos County Sheriff Earl Gray Elected County Attorney Local News Theeagle Com

- Two Former Brazos County Employees Arrested For Alleged Scam At Tax Office

- Moving To The New Brazos County Tax Office Next Week Wtaw 1620am 94 5fm

- New Truth In Taxation Site Calculate Costs Learn About Changes Provide Feedback On Property Tax

More From Herman Miller Office Chair

- Corrections Officer Salary

- Www Office 365

- Avent Ferry Post Office

- Sunnyside Post Office

- The Office Danny Cordray

Incoming Search Terms:

- Bryan S Leading Local News Weather Traffic Sports And More Bryan Texas Kagstv Com Kagstv Com The Office Danny Cordray,

- Eagle Ford Shale Brazos County Tx Eagle Ford Shale Play The Office Danny Cordray,

- Brazos County Tax Office Case Studies Fabral Architectural The Office Danny Cordray,

- Brazos County Administration Building Downtown Bryan 2 Tips From 111 Visitors The Office Danny Cordray,

- Https Www2 Texasattorneygeneral Gov Opinions Opinions 48morales Rq 1997 Pdf Rq0971dm Pdf The Office Danny Cordray,

- Restrictions Passed Amid New Brazos County Coronavirus Cases Local News Theeagle Com The Office Danny Cordray,