Simplified Home Office Deduction, Taxes The Simplified Home Office Deduction Strategic Finance

- 8829 Simplified Method Schedulec Schedulef

- Small Business Home Office Deductions Simplified Newsday

- What Is Irs Form 8829 Expenses For Business Use Of Your Home Turbotax Tax Tips Videos

- The Home Office Deduction The New Simplified Option For 2013 Taxes

- Standard Home Office Vs Actual Expenses What S Better

- Keep More Of Your Cash With The Home Office Tax Deduction

- Home Based Businesses Have Simplified Way To Claim Home Office Deduction Arizona Daily Independent

- Simplified Or Actual Expense Home Office Deduction Which Should You Use Cpa For Freelancers

- Simplified Tax Deduction Available For Planners With A Home Office

- The Home Office Deduction Using The Simplified Method Taxslayer Pro S Blog For Professional Tax Preparers

Find, Read, And Discover Simplified Home Office Deduction, Such Us:

- How To Claim The Home Office Deduction With Form 8829 Ask Gusto

- New Simplified Home Office Deduction Cordasco Company

- Home Office Tax Deduction For Home Business

- Home Office Deduction How To Use The Simplified Method Easy What If I Rent My Home Youtube

- Understanding The Home Office Deduction A Beginner S Guide The Blueprint

If you re searching for Notre Dame Post Office you've arrived at the right location. We ve got 103 images about notre dame post office including images, photos, pictures, backgrounds, and much more. In such web page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

The simplified home office deduction permits a deduction allowance of 5 for each square foot of office space up to 300 square feet for a total of 1500.

Notre dame post office. For the real scoop refer to the irs publications. Disappointingly the answers here from turbotaxpersons are often just wrong. Highlights of the simplified option.

The simplified deduction is optional. Its worth 5 for every square foot that makes up your office space. In addition to the home office space deduction you may also claim mortgage interest and real estate taxes on schedule a.

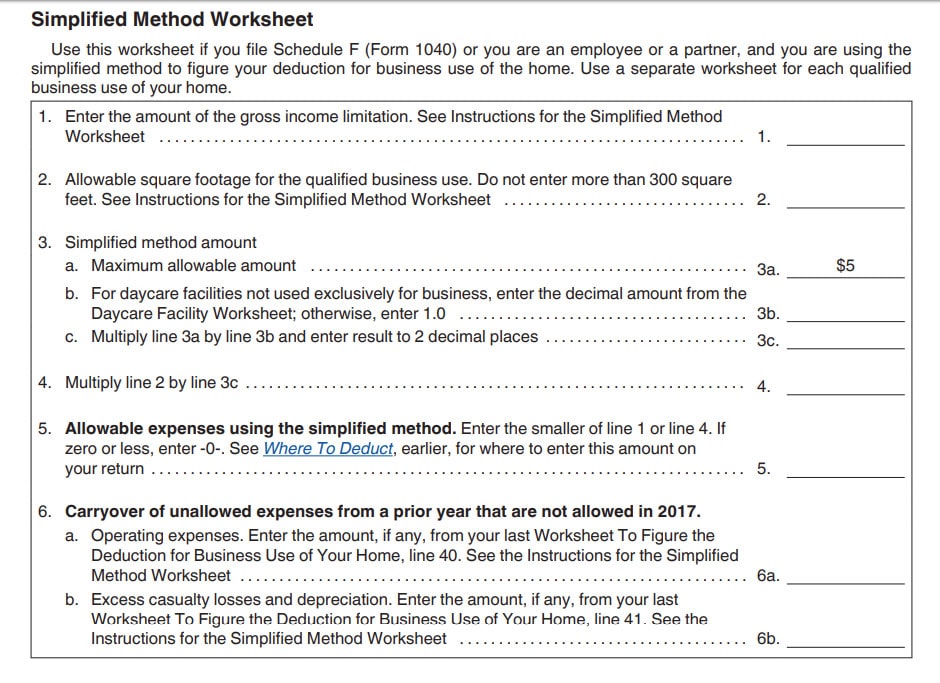

The simplified method as announced in revenue procedure 2013 13 pdf is an easier way than the method provided in the internal revenue code the standard method to determine the amount of expenses you can deduct for a qualified business use of a home. It is capped at 1500 a year based on 5 a square foot for up to 300 square feet. For anyone who wants to claim the simplified home office deduction the irs allows you to claim a deduction thats based on the square footage of your office.

The deduction is capped at 1500 per year so the maximum space you can claim is 300 square feet. Canadians will be able to deduct 400 under a simplified home office expense deduction on their 2020 income tax return according to the federal governments new fall economic statement released. The aim of this option is to reduce paperwork and recordkeeping burdens on small businesses.

Allowable home related itemized deductions claimed in full on schedule a. Mortgage interest real estate taxes. No home depreciation deduction or later recapture of depreciation for the years the simplified option is used.

If tracking the various expenses for maintaining your home seems like too great a chore the irs offers a simplified method for calculating the home office deduction. Standard deduction of 5 per square foot of home used for business maximum 300 square feet. For those working from home further financial benefits can be enjoyed in 2020 from home office expenses.

This method allows a deduction of 5 per square foot used for business up to a maximum of 300 square feet. What is the simplified method for determining the home office deduction. On monday the government released its fall economic statement and announced a simplified.

Instead you use the worksheet in the schedule c instructions.

Notre Dame Post Office, Simplified Home Office Deduction Youtube

- What Is The Simplified Home Office Deduction 2020 2021

- Simplified Option For Home Office Deduction

- Standard Home Office Vs Actual Expenses What S Better

Notre Dame Post Office, Simplified Home Office Deduction When Does It Benefit Taxpayers

- The Basics Of The Simplified Home Office Deduction Taxact Blog

- Home Office Deduction Definition Eligibility Limits Exceldatapro

- Do You Qualify For A Home Office Tax Deduction

Notre Dame Post Office, Home Office Deduction One Of The Most Misunderstood Tax Breaks Realtor Com

- Your Home Office Tax Deductions For Small Business

- Deducting Home Office Expenses Journal Of Accountancy

- Taxes The Simplified Home Office Deduction Strategic Finance

More From Notre Dame Post Office

- Post Office Gateway

- Henry County Child Support Office

- Wic Office Buffalo Ny

- Biggest Box Office

- Redlands Post Office

Incoming Search Terms:

- The Home Office Deduction Turbotax Tax Tips Videos Redlands Post Office,

- The Home Office Deduction Actual Expenses Vs The Simplified Method Seber Tans Plc Redlands Post Office,

- K0gxjx1voegncm Redlands Post Office,

- Home Office Deductions Everything You Need To Know Who S Eligible And How To Calculate Them Redlands Post Office,

- Home Office Deduction Definition Eligibility Limits Exceldatapro Redlands Post Office,

- 8829 Simplified Method Schedulec Schedulef Redlands Post Office,